Provident Fund Registration Consultant

Are you Looking for Employer (PF) Provident Fund Registration Consultant? We provide Provident Fund Registration Service Across India Near to you. Get Your PF Registration Code Within One Hour. Provident Fund Registration is Mandatory for Company who is employing 20 or more employee, Voluntary Registration can be obtained even if employees are less than 20. Get Instant PF Certificate for Tender Purpose.

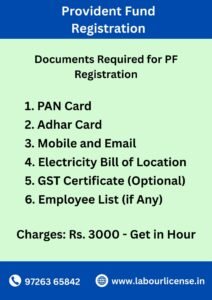

Charges for PF Registration – Rs. 3000/-

Combo PF & ESIC Registration – Rs. 4000/- (for Both)

Looking for PF Registration Consultant?

Provident Fund (EPF) Registration

As per The Employees’ Provident Fund and Miscellaneous Provisions Act 1952, Provident Fund Registration is Mandatory for the Establishment (Company/Firm/Employer) employed 20 or more employees. Every Establishment who is registered with EPF requires to file monthly Return with Payment of Contribution. Also, Employer with lessthan 20 Employee can take PF Registration under voluntary scheme. We provide PF Fund Registration Consultancy with Complete Online Process, We can get you Provident Fund Certificate within one hour Across India Covering All City Near to you.

Applicability of Provident Fund Registration for Employer

Provident Fund Compulsorily required for Following Establishment/Company

- Company or Firm is having 20 or more employees required to obtain PF Code

- Factories engaged in Industries specified in Schedule I of the Act

- Other Establishment Notified by Central Government

- Voluntary Registration under Provident Fund

- Employer having less than 20 employee can obtain PF Registration under voluntary scheme

- Tender Purpose PF Requirement Registration

What are the Documents Required for Employer PF Code Registration?

For the purpose of Employer’s Provident Fund Registration Following Documents are necessary

- PAN Card of Owner

- Aadhar Card of Owner

- Mobile and Email id

- Electricity Bill or Utility Bill of Premises (Rent Agreement if Rented)

- Sample Signature

- Employee List (if Any)

- If Partnership Firm or LLP or Trust etc (Agreement and PAN Card of Business)

Rules of PF Contributions

- Coverage of Employees Under Provident Fund Scheme are Employees who is having salary less than or Equal to Rs. 15000/- Per Month. (Employee who is having higher salary can voluntarily opt for Provident Fund)

- Contribution Rates

- Employee Contribution is 12% of Salary (Which Goes to EPF – 12%)

- Employer Total PF Contribution is 12% + 1% of Salary (12% Consist EPF, EPS and 0.5% EDLI, 0.5% Admin Charge)

- Employee Can Contribute more than 12% of Rs. 15000/- if they wish to do so, However Employer has no obligation to match contribution, Employer can pay only upto Ceiling limit of wages ie. 15000/-

- Person can opt out of PF if on the joining day following condition fulfilled

- If He/she is not having Previous PF Account Number (UAN) on the date of joining AND He is drawing Salary more than Rs. 15000/-

Process of Online Provident Fund Registration - Get in One Hour

Are you want to Apply for Provident Fund Registration Online? Here is simple steps to process in which you will get PF Registration Certificate within One Hour.

- Make Inquiry – Connect with our Expert, We will guide you applicability and suitability in a way to get Registration as per the provisions and rules of Act.

- Send us Documents – Check the list of documents as stated above, send us via WhatsApp, Email or Physical.

- We will prepare a Draft Registration Application and Send you for Verification Purpose.

- On your Approval we will file the PF Registration Application. Within One Hour You will get the Certificate of Registration.

Provident Fund Consultant Near You

We are the Nearest Provident Fund Registration Consultant, Serving Across India like Major City Ahmedabad, Mumbai, Kolkata, Hyderabad, Delhi, Bengaluru, Chennai etc Including the All State From Gujarat to Assam, Jammu to Kerala. We help in Registration, Return Filing, Implementation of PF in Company, Wages and Salary Structure Decisions etc. We Provide Following Services

- PF Registration Consultant Service

- PF Return Filing Service

- Implementation of PF in Organization

- Salary Structure Decision, Policy Drafting etc

- Tender Purpose Labour Law Compliance

FAQ's on Employer PF Registration

- I want to Take Registration of PF with my Home Address, is it possible?

Yes, There is no compulsory requirement of Business Commercial Place.

- I don’t have any Business Proof Document, Can i Get EPF Registration?

Yes, PF Registration doesn’t Required Business Proof as such. If you have fresh business or Business without Statutory document still you can get Registration.

- Can i take/continue PF Code with Zero Employee?

You can continue PF Code with Zero Employee and Zero Contribution. Rs. 75/ Require to pay per month for Such continuation. (Suitable for Tender Purpose)